Aave experiences a significant 95% surge since its April lows, driven by scarcity in its supply, triggering a rally.

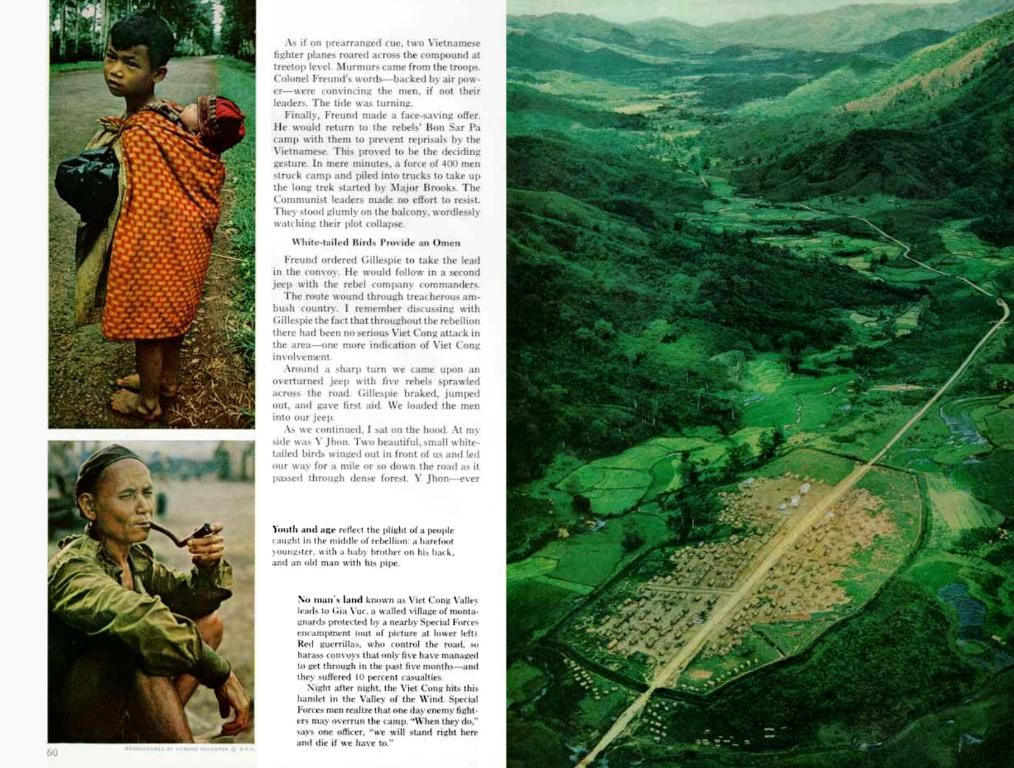

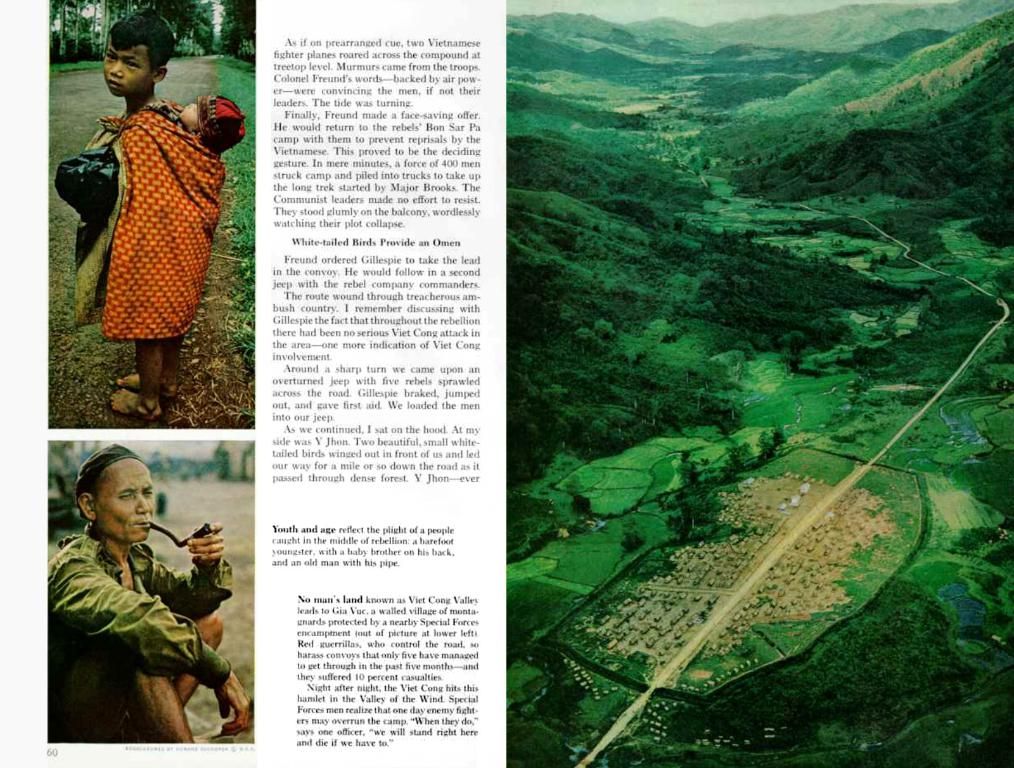

Aave's price soared on Saturday, hitting a high not seen since March 6 this year, as exchange balances plummeted and the total value locked in its network diminished.

The Aave token, symbolized as AAVE, shot up to $221.91, marking a monumental 95% rise from its April 7 low. This surge propelled its market cap above the $3 billion mark.

Data from CoinGlass reveals an ongoing accumulation of AAVE tokens, notably after Ethereum breached the key resistance point at $2,400 for the first time since February.

The AAVE tokens stashed away in exchanges dropped to 4.76 million, a decrease from 4.87 million a week ago. This withdrawal reduced the total supply on exchanges to 29.74%, signaling that holders are reluctant to sell, a positive sign for a coin.

Aave solidified its role as the biggest player in the decentralized finance (DeFi) industry. DeFi Llama data indicates a 35% increase in its total value locked over the past 30 days, making it significantly larger than Lido (LDO) with its $21.6 billion in assets.

This growth has transformed AAVE into one of the most profitable players in the crypto sector, with year-to-date fees jumping to a substantial $224 million.

AAVE serves as a decentralized 'banking' platform that allows users to earn interest from their idle assets. This interest is derived from its lending operations, enabling users to borrow at competitive rates.

Aave's Market Dominance in DeFi

Aave's dominance in the DeFi sector can be attributed to several factors:

- Leading DeFi Lending Platform: Aave is one of the largest decentralized lending protocols by Total Value Locked (TVL) and adoption, offering a diverse array of lending and borrowing markets. Innovation and robust security help maintain its market leadership.

- Continuous Product Innovation: Regular product innovation, such as protocol upgrades and new features like decentralized stablecoins, keeps Aave at the forefront of the competitive DeFi landscape.

- Expanding Ecosystem: Aave's governance token AAVE benefits from a burgeoning community and institutional stakeholders, strengthening its influence in the DeFi space.

Aave's Price Trends

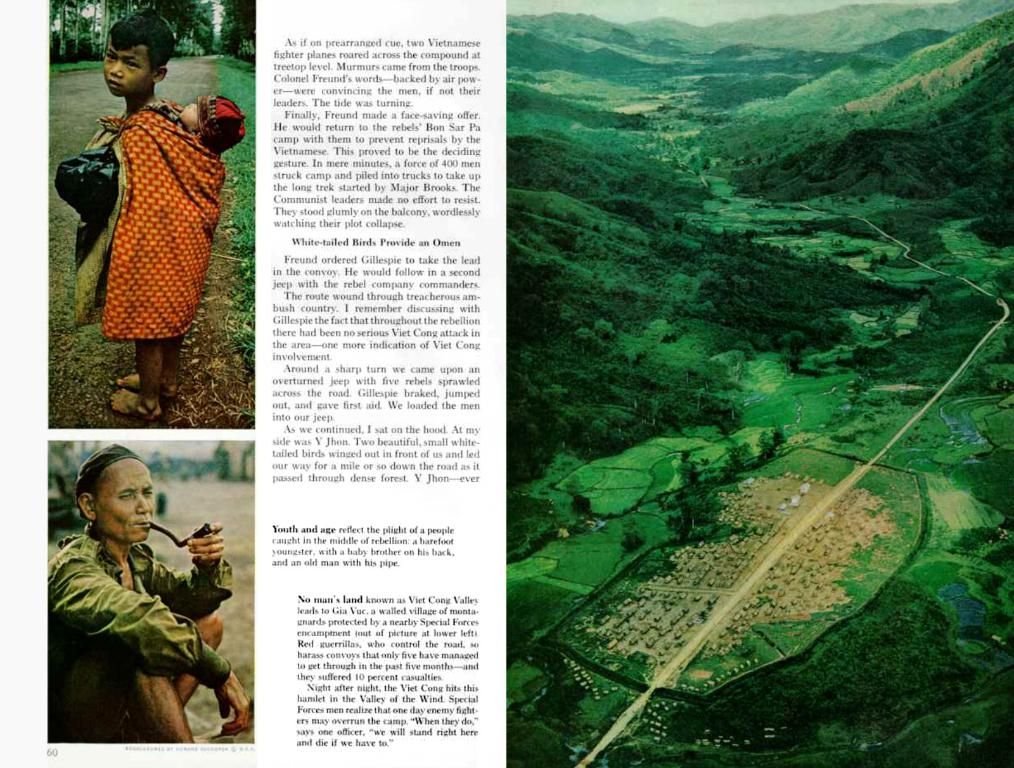

The daily chart shows AAVE bottoming out at $113.50 on April 7, bouncing back to its March 6 high. It has surpassed the 50-day Exponential Moving Average and the psychologically significant $1,000 mark.

The Relative Strength Index (RSI) has moved to an overbought level at 75, while the MACD indicator has crossed the zero line.

This rebound occurred after it formed a falling wedge pattern between December and April. As such, it appears the coin will continue to rise, with bulls targeting the key resistance level at $400, its highest point in December. This move would signify an 83% surge from the current level. A drop below the support at $170 would negate the bullish outlook.

Potential Concerns

While there is optimism surrounding Aave, there is also concern over the Securities and Exchange Commission (SEC) and the potential for increased regulation in the crypto space, which could affect Aave's operations and growth.

Aave's continued success in the DeFi sector hinges on a delicate balance between innovation, regulatory compliance, and market demand, making it crucial for investors to closely monitor the changing regulatory landscape.

[1]: Source: DeFiJackal[2]: Source: DeFi Splendid[3]: Source: Glassnode[4]: Source: The Crypto Basic

- The success of Aave's token, AAVE, has been notable, with its price reaching $221.91 - a significant 95% rise from its April low.

- This surge propelled AAVE's market cap above the $3 billion mark, solidifying its role as a major player in the crypto sector.

- Data from CoinGlass reveals an ongoing accumulation of AAVE tokens, a positive sign for holders as the total supply on exchanges has decreased.

- Aave's dominance in the DeFi sector is due to its status as a leading decentralized lending platform, continuous product innovation, and a growing ecosystem.

- The rebound in Aave's price has taken it past the 50-day Exponential Moving Average and the psychologically significant $1,000 mark, but the Relative Strength Index (RSI) has moved to an overbought level at 75.

- The MACD indicator has crossed the zero line, indicating a possible continuation of the upward trend, with bulls targeting the key resistance level at $400.

- However, potential concerns for Aave include increased regulation in the crypto space by the Securities and Exchange Commission (SEC), which could affect its operations and growth.

- Investors must closely monitor the changing regulatory landscape to ensure Aave's continued success in the DeFi sector.