Cryptocurrency Pioneer Accused of $50 Million Tax Evasion

Roger Ver, Known as "Bitcoin Jesus," Faces Tax Fraud Charges, Potential Prison Sentence

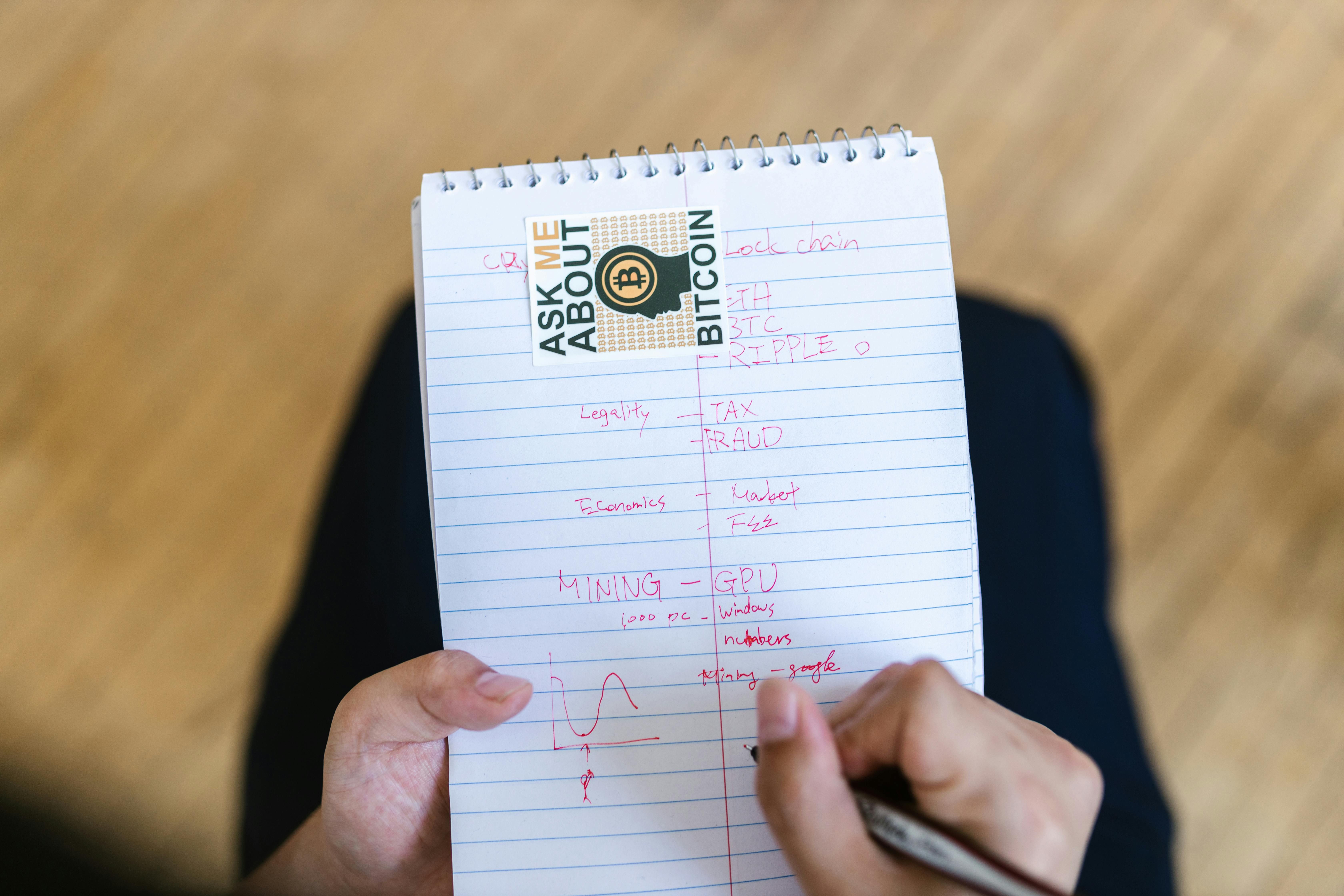

California's infamous early crypto investor, Roger Ver, aka "Bitcoin Jesus," is in hot water, with federal charges of tax fraud hanging over him. The Department of Justice alleges that Ver evaded nearly $50 million in taxes, committing mail fraud and tax evasion.

In a recent indictment filed in the Federal Court of Los Angeles, Ver faces three counts of mail fraud, two counts of tax fraud, and three counts of filing a false tax return. His cold capture in Spain over the weekend has U.S. authorities scrabbling for his extradition.

Remembered for his zealous crypto evangelism, the 45-year-old Ver left his US citizenship behind in February 2014 to become a St. Kitts and Nevis citizen. Controversy strikes, though, as allegations assert that Ver didn't disclose his 131,000 Bitcoins he owned at that time during his citizenship changeover. The concealment strategy supposedly enabled him to dodge taxes, underrepresent his Bitcoin stash, and evade taxes. Currently, the value of his Bitcoin cache is a mammoth $7.5 billion, with each Bitcoin trading around $57,000.

The indictment gains ground on the heels of Binance founder Changpeng Zhao's guilty plea to money laundering last year, who recently served a four-month jail term. And it follows Sam Bankman-Fried, the former CEO of FTX crypto exchange, being sentenced to a whopping 25 years in prison.

This Quartz-featured article sets the stage for an intriguing legal standoff, with potential penalties amounting to a staggering 109 years if Ver is found guilty on all counts. Follow the story as it unfolds within the crypto community, with voices rallying behind "Bitcoin Jesus" or questioning the fairness of the government's actions.

- The tech industry, already under scrutiny with the recent indictment of Roger Ver, known as "Bitcoin Jesus," faces another challenge as the future of cryptocurrency regulation becomes increasingly complex.

- Despite his successful investments in tech and early advocacy for cryptocurrency, Roger Ver's future hangs in the balance as he faces tax fraud charges, potentially leading to a lengthy prison sentence.

- The indictment against Ver highlights the need for transparency in the tech and cryptocurrency industries, particularly regarding the reporting of assets and tax liabilities by individuals like Ver who own significant amounts of crypto, such as the 131,000 Bitcoins he had in 2014.

- The tech sector may witness a shift in investment patterns and public opinions due to Ver's ongoing legal battle, as the implications for the future of taxation and regulation in the cryptocurrency market become more pronounced.