Increase in telecommunication companies doesn't stave off significant drop in online users for Nigeria over a six-month period

==============================================================

The Nigerian telecommunications sector, once a beacon of growth, is facing a setback as the cost of smartphones and data tariffs have soared, leading to a slowdown in internet adoption and exacerbating the digital divide.

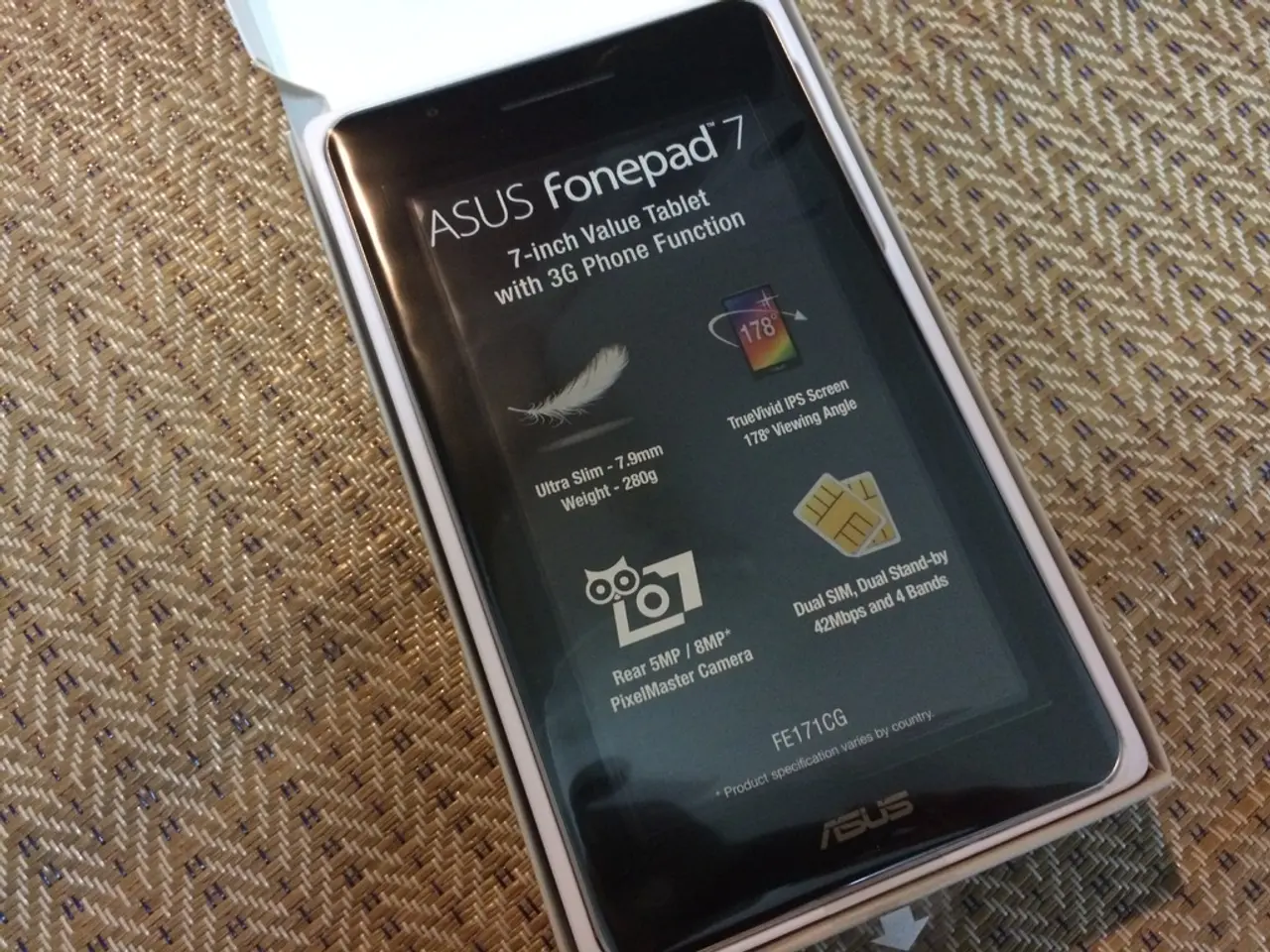

Between January and June 2025, the total active internet subscriptions in Nigeria decreased by over 1 million, despite a growth in revenue for telecommunications companies like MTN and Airtel [1][3]. The average cost of a high-end smartphone like Apple's iPhone 15 Pro Max 1TB now exceeds ₦2.3 million, while entry-level devices retail for ₦200,000–₦220,000, up from ₦120,000–₦180,000 earlier in the year [1][3]. Even affordable secondhand iPhones have climbed beyond ₦130,000, making digital access out of reach for many low-income Nigerians.

In an attempt to boost revenue, the Nigerian Communications Commission (NCC) approved a 50% data tariff hike in January 2025, raising the cost of 1GB from around ₦287.50 to ₦431.25 [1]. This sharp rise has forced existing users to ration data and has deterred new users from subscribing.

Smartphone imports have also declined sharply (nearly 40% drop from 2024 to 2025), driven by foreign exchange shortages, naira depreciation, and customs duties hikes. These economic pressures have reduced the availability of new devices, further raising prices [2].

Policy disruptions, such as the temporary suspension of national identification number (NIN) verifications needed for new SIM cards, have also slowed internet user growth [1]. In June 2025, the onboarding of new internet subscribers was effectively frozen due to the National Identity Management Commission (NIMC) suspending NIN verifications.

Despite these challenges, some telecommunications companies have reported strong data revenue growth. For instance, MTN Nigeria added 3.3 million active data subscribers within six months, driving its 69.2% year-on-year data revenue growth [6]. However, the actual number of active internet users fell from 141.6 million to 140.6 million from January to June 2025, underscoring stalled internet penetration growth [1][3].

In conclusion, the combined impact of rising smartphone costs, increased data tariffs, import constraints, inflation, and policy hurdles are increasing the economic barriers to internet access in Nigeria, thereby widening the digital divide between those who can afford connectivity and those who cannot [1][2][3]. The industry must find ways to address these challenges to ensure digital inclusion and sustainable growth.

References: [1] Nairametrics (2025). "The Impact of Rising Data Tariffs on Internet Adoption in Nigeria." [Online] Available at: https://www.nairametrics.com/2025/07/01/the-impact-of-rising-data-tariffs-on-internet-adoption-in-nigeria/

[2] The Guardian Nigeria (2025). "Smartphone Imports Plummet as Costs Soar in Nigeria." [Online] Available at: https://guardian.ng/business-news/smartphone-imports-plummet-as-costs-soar-in-nigeria/

[3] Premium Times (2025). "The Digital Divide: How Rising Costs and Tariffs are Excluding Nigerians." [Online] Available at: https://www.premiumtimesng.com/business/technology/484545-the-digital-divide-how-rising-costs-and-tariffs-are-excluding-nigerians.html

[4] BusinessDay (2025). "Data Consumption Becomes More Cautious and Need-Driven in Nigeria." [Online] Available at: https://www.businessdayonline.com/technology/data-consumption-becomes-more-cautious-and-need-driven-in-nigeria/

[5] ThisDay (2025). "NCC Approves 50% Data Tariff Hike." [Online] Available at: https://www.thisdaylive.com/index.php/2025/01/01/ncc-approves-50-data-tariff-hike/

[6] Vanguard (2025). "MTN Nigeria's Data Revenue Grows 69.2% in H1 2025." [Online] Available at: https://www.vanguardngr.com/2025/07/mtn-nigerias-data-revenue-grows-69-2-in-h1-2025/

- The increasing costs of high-end and entry-level mobile devices, such as Apple's iPhone 15 Pro Max 1TB and affordable secondhand iPhones, in the Nigerian market, coupled with a surge in technology-related finance costs like data tariffs, are impeding digital inclusion and fostering a wider digital divide.

- The combined rise in mobile technology and finance costs, with an estimated 40% drop in smartphone imports, data tariff hikes, inflation, and policy hurdles, is contributing significantly to the economic barriers faced by many Nigerians wanting to access the internet, thereby exacerbating the digital divide.